July 28, 2025 – The Directorate General of Trade Remedies (DGTR), the investigative arm of India’s Ministry of Commerce, published its final investigation findings regarding the anti-dumping case involving imported "T-shaped elevator/lift guide rails and counterweight guide rails" originating in or exported from China.

The investigation was initiated following a petition filed by Savera India Riding Systems in June 2024. The petition alleged that the domestic elevator industry was suffering significant injury due to dumped imports and requested the imposition of anti-dumping duties.

According to a ResearchAndMarkets report published on Businesswire, the Indian elevator and escalator market is projected to grow significantly, from a valuation of $3.54 billion in 2023 to $7.2 billion by 2031, reflecting a Compound Annual Growth Rate (CAGR) of 8.2%. This growth is driven by rapid urbanization, infrastructure development, and increased residential and commercial construction.

The DGTR's final investigative conclusions determined that, based on the normal value and export prices of the subject goods, dumping margins for these items were positive and substantial.

Market demand for the product in India surged by 71% during the investigation period, yet the market share of Indian producers declined markedly. India's domestic elevator guide rail manufacturing industry failed to achieve optimal production levels, despite having the capacity to meet nearly 40% of product demand.

The DGTR also found that import prices from China had plummeted, falling below even the raw material costs of Indian manufacturers. This compelled domestic firms to slash prices to remain competitive, resulting in significant reductions throughout the investigation period.

"Profitability, cash flow, PBIT (profit before interest and taxes), and return on capital employed for the domestic industry all deteriorated during the investigation period, except in 2021-2022. Profits in the base year turned into losses during the period of investigation," the DGTR report highlighted.

The DGTR's findings indicate that India's industry producing T-shaped elevator/escalator guide rails and counterweight guide rails has suffered material injury due to dumped imports. The injury margin is substantial.

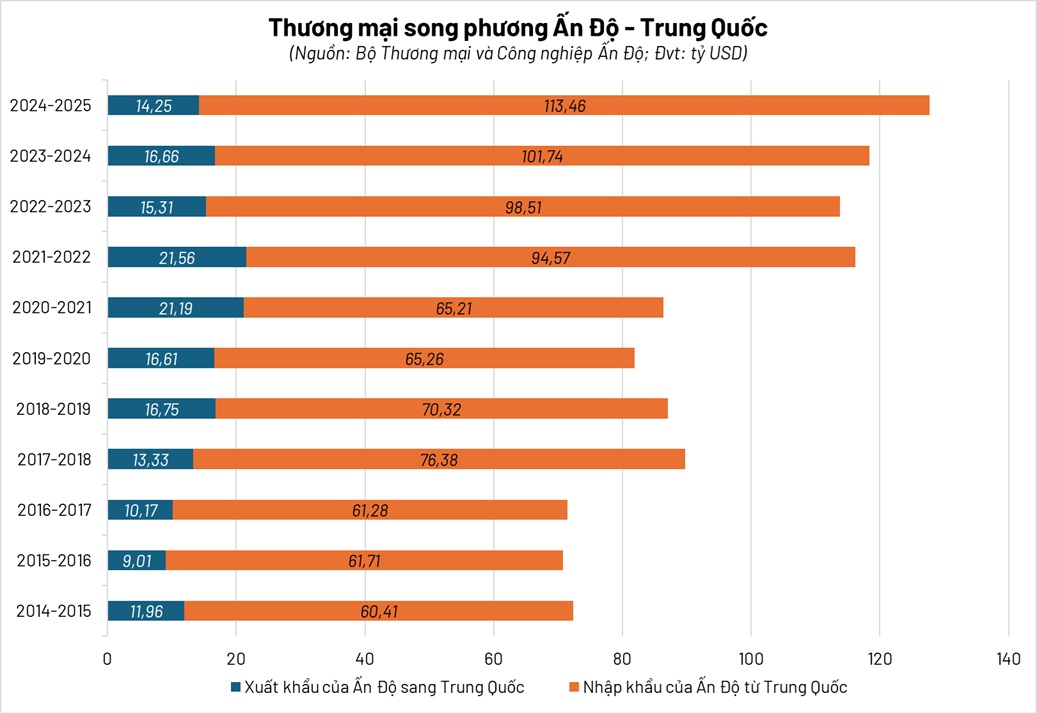

The trade balance between the two nations tilts heavily toward China, with the gap widening steadily. Chart: Elevator Magazine

Following a comprehensive investigation and quantification of the duty's impact, India's Ministry of Commerce investigative authority concluded that imposing anti-dumping duties is essential to offset this injury and restore a level playing field for domestic producers.

Accordingly, the DGTR recommended anti-dumping duties ranging from 24.11% to 51.87% on the CIF (cost, insurance, and freight) value of imported T-shaped and counterweight guide rails originating from or exported by China, for a duration of five years.

The DGTR emphasized that such duties would not disrupt product supply to consumers.

This investigation and recommendation comply with World Trade Organization (WTO) rules, of which both India and China are members. The aim is to ensure fair trade practices and create an equitable environment for domestic manufacturers.

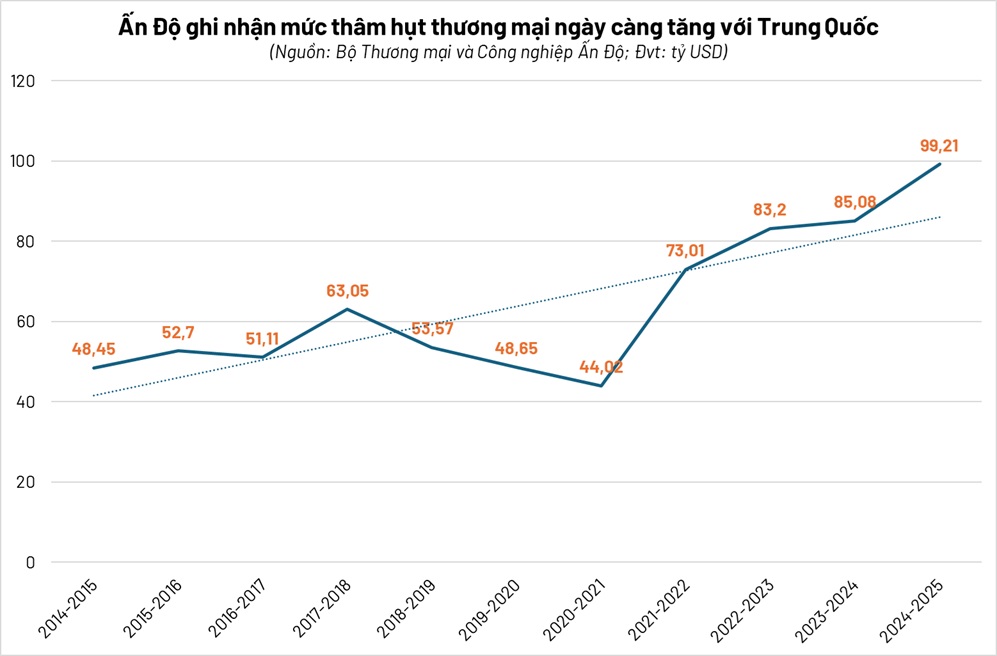

India-China Trade Deficit Hits Record Near $100 Billion

From April to July in the 2025-2026 fiscal year, India's exports to China rose 19.97% to $5.75 billion, while imports climbed 13.06% to $40.65 billion.

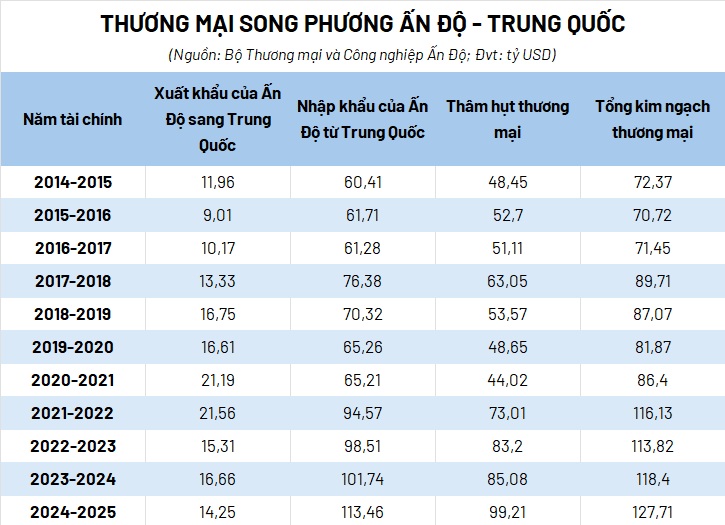

Data released by India's Ministry of Commerce and Industry on April 16, 2025, revealed that in the 2024-2025 fiscal year (ending March 31), India exported $14.25 billion to China but imported $113.5 billion. The trade deficit with China ballooned from $1.1 billion in 2003-2004 to a record $99.2 billion in fiscal 2024-2025.

India-China Bilateral Trade Over the Past 11 Years. Table: Elevator Magazine

This imbalance underscores structural challenges in India's economy. According to the Delhi-based Global Trade Research Initiative (GTRI), the import surge reflects growing reliance on Chinese components, particularly in electronics, pharmaceuticals, and engineering sectors. GTRI's analysis shows China supplies over 75% of India's needs for certain key products.

In response, India is devising long-term strategies to reduce dependence on China, including boosting domestic manufacturing and diversifying supply chains through partnerships with other nations.

Overcapacity in production makes Chinese goods more competitively priced. Photo: Reuters.

Meanwhile, following discoveries of substandard equipment and products imported from China, India has imposed anti-dumping duties on various items to counter low-cost imports from multiple countries, including China—ranging from chemicals to technical products—with the goal of shielding domestic producers from cheap imports.

In particular, the country has ramped up enforcement of quality standards, inspection processes, and mandatory certifications to bar inferior products from entering the market. This initiative also seeks to incentivize local manufacturers to enhance production capabilities.

India-China Trade Deficit Hits Record Near $100 Billion in Fiscal 2024-2025. Chart: Elevator Magazine

According to the Times of India (TOI), the escalating trade deficit strains foreign exchange reserves and heightens reliance on foreign suppliers. While cheap imports may benefit consumers short-term, they can harm domestic manufacturers. Excessive import dependence could also depreciate the local currency, inflating import costs and fueling inflation.

Experts warn that this reliance diminishes incentives for building domestic production capacity in strategic sectors, potentially slowing long-term industrial growth and innovation.

https://tapchithangmay.vn/trung-quoc-xuat-khau-thang-may-nhieu-nhat-toi-thi-truong-nao/

![[Photos] Impressions of Vietnam Elevator Expo 2025 [Photos] Impressions of Vietnam Elevator Expo 2025](https://media.tapchithangmay.vn/share/web/image/2026/1/mobi6703639038935945497270_350x210.webp)