0989.761.499

0989.761.499 contact@tapchithangmay.vn

contact@tapchithangmay.vn  18/647 Lạc Long Quân, Tây Hồ, Hà Nội

18/647 Lạc Long Quân, Tây Hồ, Hà Nội

Any form of using the content published by Elevator Magazine at www.tapchithangmay.vn must be approved in writing by the Magazine.

© TapchithangmayLicense No: 510/GP-BTTTT dated 06/08/2021

Editorial's Office: 18/647 Lac Long Quan Street, Tay Ho District, Hanoi

Deputy Editor-in-Chief in charge: Trinh Hong Le

Magazine SubscriptionsAny form of using the content published by Elevator Magazine at www.tapchithangmay.vn must be approved in writing by the Magazine.

© Tapchithangmay

![[Infographic] Top 5 highest building in Vietnam [Infographic] Top 5 highest building in Vietnam](https://media.tapchithangmay.vn/share/web/image/2025/08/top-5-toa-nha-cao-nhat-vietnam-2_300x172.jpg)

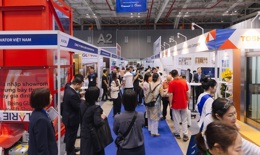

![[Photos] Impressions of Vietnam Elevator Expo 2025 [Photos] Impressions of Vietnam Elevator Expo 2025](https://media.tapchithangmay.vn/share/web/image/2026/1/mobi6703639038935945497270_260x155.webp)

![[Infographic] Top 5 highest building in Vietnam [Infographic] Top 5 highest building in Vietnam](https://media.tapchithangmay.vn/share/web/image/2025/08/top-5-toa-nha-cao-nhat-vietnam-2_185x125.jpg)