EM – In recent years, Vietnam’s elevator market has been vibrant with a full range of different market share segments, fierce competition. In particular, the price race has indirectly dragged businesses into the “spiral” of deadlock. What do we see in this matter?

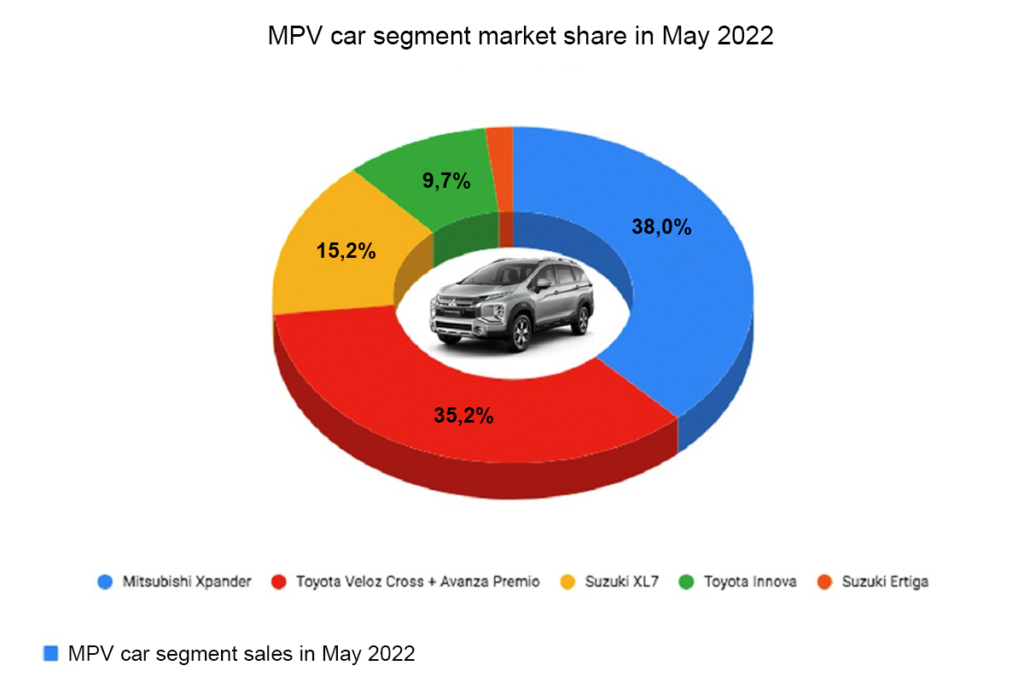

What do you see in the race for MPV market share?

Let’s talk about cars so it’s easy to imagine the story. In the Vietnamese market, the MPV (Multi Purpose Vehicle) models of three Japanese manufacturers are in the price segment of about 550 – 700 million VND. In terms of structure, equipment is also almost the same. They are all with 7 seats, 1499 cm3 engines, manual seats, manual trunk opening, etc. So how do these manufacturers compete?

In fact, every year when releasing new MPV models, manufacturers make certain improvements in terms of style, design, technology, interior, etc. It is worth mentioning that manufacturers mainly compete by investing in improvements and additions of technology and utilities, rather than lowering prices to increase competitive advantages for their products.

Automotive businesses compete fiercely but strictly comply with regulations

And despite fierce competition, businesses in the auto industry seriously comply with Vietnam’s regulations on standards, pre-inspection, inspection, etc.

We have National Technical Regulation QCVN 09:2015/BGTVT National Technical Regulation on quality, technical safety and environmental protection for automobiles, Circular 30/2011/TT-BGTVT Regulations Regulations on quality control, technical safety and environmental protection in the production and assembly of motor vehicles, etc., stipulate strict requirements for quality inspection, technical safety and environmental protection for types of cars manufactured, assembled or imported. In particular, it is very clear that they must test typical models for motor vehicles, make test reports and take responsibility for their own test results.

That’s the car, what about the elevator?

Push each other into the vortex

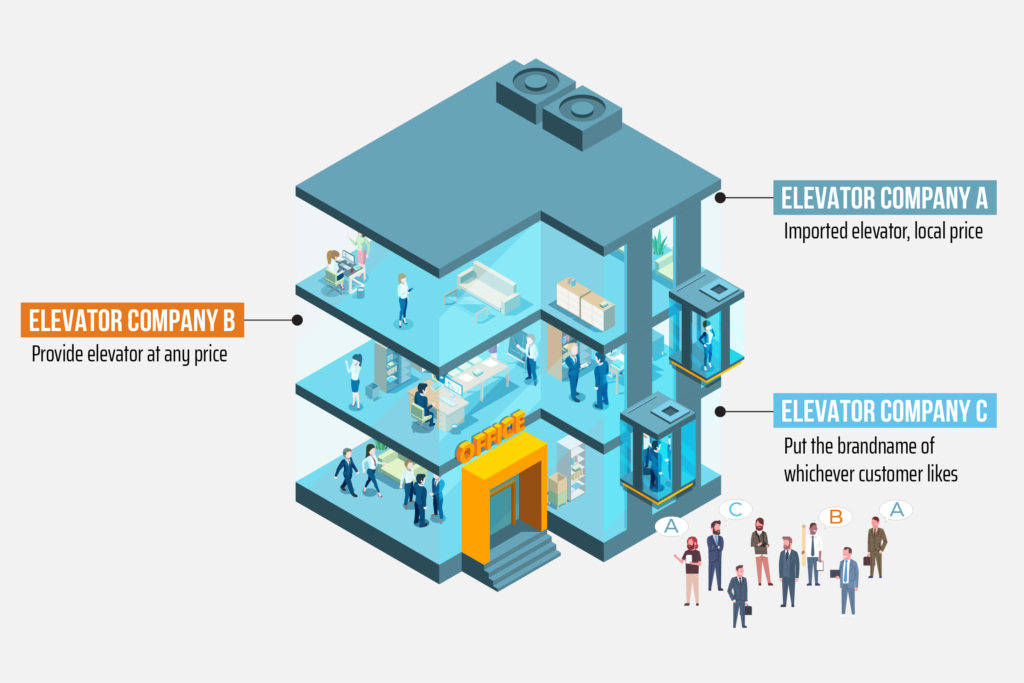

While automobile businesses compete within the framework of the law, by technology, quality, and utility, how do elevator businesses compete with each other? Identifying business groups with their core interests, we will shape the market, its segment and its basics.

Vietnam’s elevator market currently consists of groups of businesses with different sizes, goals and business strategies.

Group 1: Group of long-standing Vietnamese enterprises (about 10 years or more).

As a group of Vietnamese enterprises participating in the elevator market in the initial stage. They are fortunate to have exclusive contracts to distribute products to a number of foreign manufacturers and have enough time to accumulate capital, achieve relative scale, and have good processes and governance. However, when the product brands of foreign manufacturers are built and developed by Vietnamese enterprises, it is these foreign enterprises that jump in to control the new selling market, regaining long-term revenue. , stability from maintenance services, routine maintenance or elevator repair. Because there is no backup plan to protect themselves in advance, Vietnamese businesses are suddenly unable to respond, have a crisis of development strategy and face the risk of being excluded from the game or accepted completely dependent.

Elevator businesses compete uncontrollably

Group 2: Emerging enterprises.

When the mechanisms and policies of the state were more open, a part of personnel who used to work for the first group of elevator companies split up to open their own businesses. Notably, opening a business is so easy that you just need to submit a registration file and a small fee, and meet the requirements for paperwork to have a “seal” in your hand. This group is characterized by having a certain level of technical expertise accumulated from the previous workplace. But due to their knowledge of management, marketing, and limited financial potential, they can only maintain small-scale businesses. These groups are only capable of ordering production of elevators according to certain models and selling them to customers and then “transferring” the installation and maintenance services to other units in order to make a profit.

This group is usually small businesses, but makes up the majority of the number of businesses in the elevator industry. Due to the lack of brand name and weak field capacity, they mainly focus on marketing on the household customer segment. It is worth mentioning that there are many businesses in this group that are willing to sell products at any price, just need a little profit. Because of the pressure of cash flow to rotate capital, they do not care much about responsibility and handle other risks for customers in after-sales service. It can be the calculation of the reserve of spare parts, replacement equipment … in the elevator price. With such an operating mechanism, the safety of consumers is overlooked, the future development is also uncertain when it is difficult to predict the trend of these businesses.

Group 3: Vietnamese enterprises directly manufacturing elevators.

This is a group of enterprises that directly manufacture some simple equipment for elevators or order parts and equipment to be manufactured, then assemble and sell products to group 2 enterprises. This process is called OEM. (Original Equipment Manufacturing). Some enterprises in group 2 will label certain brands to sell to the market. Such products often include most equipment and components imported from many sources, with a very small localization rate, very low added value, and are currently not evaluated, tested, or sourced. origin and quality to carefully consider whether it is in accordance with national regulations and standards (?!). Products of this group of enterprises are often difficult to control in terms of quality and safety.

Group 4: Group of foreign enterprises.

As 100% foreign owned companies established in Vietnam, mainly performing the commercial part including sale, installation, maintenance fee, etc. They are occupying the majority of the elevator market for Vietnamese high-rise buildings. A large part of revenue from the Vietnamese elevator market falls into this group of businesses. While Vietnam needs “know-how” of technology or cooperation in production investment, this group of businesses almost does not transfer to Vietnam any core technology. Some businesses that have links to train technicians to install and maintain elevators to serve themselves, transfer a simple technical part. Currently, this group of businesses also uses price reduction tactics to compete. But they have a monopoly on elevator control software, holding technological know-how, so they can take advantage of the benefits of replacing components, spare parts and maintenance at high prices from the 3rd year since customers buy and use the product. In other words, customers can buy elevators at competitive prices but it will cost a lot to “raise” elevators.

What factors are needed to promote development?

The reality of elevator businesses for short-term benefits is pushing each other into a spiral of stalemate with the obvious consequences that all parties suffer. So what is the solution to this problem?

Firstly, it is necessary to standardize, improve professional skills and foster professional ethics, the basic foundation for sustainable development of enterprises. Look to Korea and learn from Samsung. In the last 5 years of the 20th century, each year, this group selected 400 young employees, had at least 3 years of experience, were funded and sent them abroad for 1 year, creating opportunities for the employees This potential research, market penetration, search, learn new knowledge. Samsung’s seeding program is estimated to have cost up to $100 million. In return, they have 2,000 key kernels for the plan to conquer the world market and Samsung has been very successful with this bold project.

Secondly, it is necessary to develop administrative capacity for the management team. A good manager must have full professional capacity and management capacity. That helps them to both advise higher management to build a development strategy and effectively implement that strategy for their subordinates. And that helps the business to develop methodically and in the long term. .

Thirdly, build the spirit of corporate culture – nation, a very new concept but extremely necessary in the strategy of sustainable development of enterprises. Each business will have different strategies to make a difference in competition and development. Countries around the world have their own development strategies, but Vietnamese people also have their own strengths and Vietnamese culture. So why don’t we exploit our competitive strategic strengths with culture – national spirit?

Fourthly, the Government and state management agencies need to listen to the advices of professional associations and associations to promptly have policies that are close to reality and go into social life. It is a monitoring mechanism for the strict implementation of national technical regulations and standards; encourage the process of technology transfer; create a healthy environment to encourage businesses that have a heart, have a vision to develop, eliminate and limit businesses operating in a “turbidity” manner that causes the situation of “worms that upset the soup” of Vietnamese business environment.

If aware and implemented the core development strategic solution groups like that, Vietnamese elevator businesses will surely find themselves the most expensive and transparent way to get out of the deadlocked spiral, jointly develop and improve the position of elevator products “Made in Vietnam” in the international arena.

In that context, the Vietnam Elevator Association with the goal of Connecting – Unification – Development will accompany businesses in the industry. The Association has carried out specific activities and consulted with state management agencies to supplement, amend, develop and implement appropriate policies, create a healthy business and production environment, improve enterprise capacity, building a national brand for the elevator industry, creating a driving force for mutual development, contributing to the construction of the country./.