EM – Stability often brings firmness. However, when the world is in a state of VUCA, flexibility and training assist businesses easier to adapt, establish a stable status, and avoid being eliminated.

Under the circumstance of facing difficulties and fluctuations, many individuals usually have the considering mentality and waiting for the difficult period passing by thinking “every rain will stop”. This waiting mentality probably appears in uncounted businesses.

Waiting for the Russian -Ukrainian war to the end, waiting for economic recovery? So, what will happen when everything still waits but the war doesn’t end up and even worse things will arise?

Just like when the COVID-19 pandemic escalated, almost all countries around the world decided to apply disease prevention measures such as closing the border, restricting foreign flights, etc.

However, as soon as the pandemic show less severe signs, and the world economy was forecasted to recover by prestigious economic organizations, the conflict between Russia and Ukraine broke out again. The following stories are inflation rate climbing to multi-decade highs and interest rate rising for central banks’ surveillance.

As per the January 2023 Global Economic Outlook report, World Bank said that global growth was expected to arrive at only 1.7% in 2023.

This figure is 1.3 percentage points lower than the forecast in June 2022, reflecting the tightening monetary policy to restrain inflation, worsening financial conditions and resource disruptions due to the impact of Ukraine conflict.

It can be seen clearly that the world is in a period of upheaval, with all economic, geopolitical and ecological changes affecting the global prospects. So, what if businesses are not flexible to alter and just “keep their seat for the breaking dawn”?

Multiple big enterprises in the world fall into the scene of “a moment of glory and then darkness” and the question is why that is so? In the past, they were successful because they had the right strategy. But after a while, consuming psychology of customers has shifted, more and more competitors appear, and plentifully inside and outside factors of the business are no longer the same. Meanwhile, the business is still drunk on the old car, hitch themselves to be left behind and then got failure.

We can see this story clearly from the well-known failure of Nokia – an icon of the mobile industry. In just two decades, this Finnish company has created and dominated the global mobile industry with 40% market share in its days at the top.

Generous analysts believed that the reason of Nokia’s doom is strong progress of other technology companies such as Apple, Samsung and Google. However, the question arises: Why are other groups more powerful but Nokia can’t?

While Apple and Google launched iOS and Android operating systems, the mobile industry has once again been redefined around platforms, applications, and ecosystems. Meanwhile, Nokia still focuses on simple phone models.

Software segment is the most obvious Nokia’s backward when it remains loyal to an outdated operating system, Symbian.

Nokia’s failure cannot be explained with a simple answer. But via this story, under management perspectives, the market is constantly moving and becoming more and more complex, and if it is not flexible to change and adapt, businesses will have to go through the “natural screening” stage.

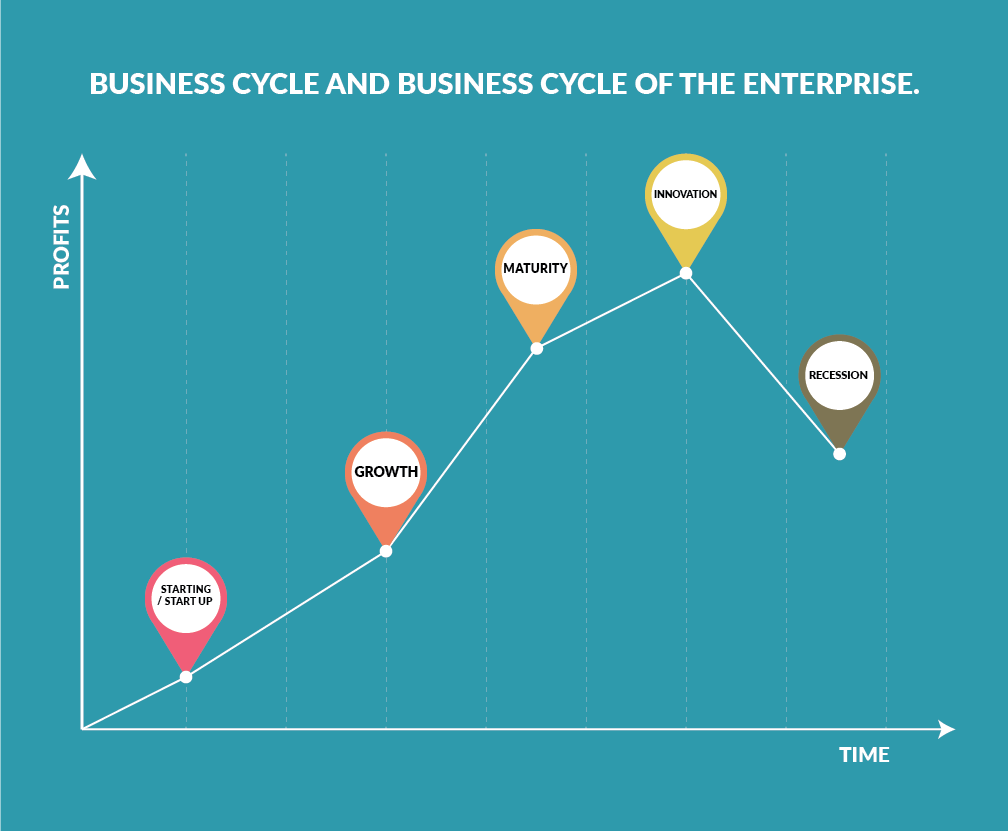

The duration in which the internal factors of a business match the external reality and thereby bring about the success of the business is called a business cycle. Every company has its own life cycle and is cyclical, the business will cope with different challenges in each stage.

That means that the strength and forte of the firm help itself to be successful in this cycle, but when it comes to the next cycle, it will no longer take a similar advantage. As a matter of fact, consumer tastes in macro policies have diversified compared to the previous business cycle. And if parties do not shift, and do not anticipate risks in the growth phase, it will facilely degenerate in the next round.

A business cycle of an enterprise used to last from 5 to 7 years, but recently due to the rapid expansion of the internet and globalization, this cycle has been shortened to 3 or 4 years.

This means that businesses today must be more dynamic, and more variable than before. Similarly, the cycles of previous economic crises are also far rarely. Yet, entering the 21st century, we see crises occur more frequently, and the time between crises shortens.

Although recession and depression have grown devastating consequences out, their causes are straightforward. It is the incompatibility amongst political, social, environmental, and economic factors. When these conflicts mount at their climax, a crisis is so inevitable that the world does approach a new balanced order.

Therefore, the faster the movement of the elements that make up this world moves, the faster the conflict between them will reach a climax and then be resolved by a crisis. That is, the frequency of crises will be thicker.

With science and technology development, the advent of the internet, and the globalization trend getting much stronger, the closer the interdependence and relationships between elements in society are, leading to the difficulty in predicting, controlling, and diversifying variables. Therefore, since 1990, the word VUCA has been introduced to describe the world of the future. It contains four main characteristics:

This means that the future of the world is painted as unpredictable, uncertain, and complex. In the coming time, there will be many strategists to help us with systematic theories and strategies to deal with the VUCA period. However, a naturally basic principle that we must understand is that if we can adapt quickly, react flexibly to the market, we will survive.

We imagine the structure of a business like a crab: we can go sideways, we can go up, we can go down, we can dive in the water, we can survive on land.

Of course, an organization or multinational corporation must systematically operate, it is impossible to imagine how the structure and management principles will be, to be flexible and shift so quickly.

If that structure is unrealistic, it’s true with Buddhist philosophy “There is birth and there is death”. Nonetheless, to prolong its life cycle, it is necessary to maximize the organization’s adjustability without breaking the system, which requires glue chemistry that unites all satellites and units together.

Not money, the ingredient is business culture. Therefore, it can be said that building corporate culture is not simply to be different in competition, to shape the corporate style to make an extraordinary in the market. It must be nourishing that glue element to build a sustainable business system in the future.

Without the crisis of a nuclear environment, whether Apple will still be here 200 years later, we cannot be sure, but we can reply certainly that the Chut ethnic group in Ha Tinh still exists and thrive if we advocate for those people to avoid inbreeding.

Why? Apple’s assets and number of employees certainly overwhelm the Chut ethnic group in Vietnam. But in terms of culture, it is definite that the Chut ethnicity is much deeper and more sustainable than Apple. That will make them exist, but Apple’s is uncertain.

A business that was previously known as an insensitive, profit-making machine must now be understood as an organic living entity: whose character is reflected in its core values, visions and ambition as well as his life value via the missions.

When the era of demand outweighs supply, technological secrets are often no longer a strength, corporations can only attract customers from trust and love. When customers feel that your business has worthy virtues and dignity, customers will use your products and put their trust in your business. On the contrary, firms need to consider each customer as a co-creator.

The core values, vision, and mission of the organization will gather together, and the people in the future will be the ecosystem of the business. To get culture be a real inner strength and capable of genetic cloning, the ideological values of the enterprise must become an “ideology” like religion.

To perform this, it is required that the mission of the head of the organization should be leveraged, beyond the ordinary value of money, their mindset shall be “serving society”, then the new business voyage is going to be more sustainable and able to pass through the “storms”.